Our

Innovation Project

Capabuild is entirely demand driven. Often, we receive training requests focusing on transfer pricing, double tax agreements and international aspects of corporate tax.

Tax Aggregator Portal (TAP)

As a non-attached agency, Capabuild has used its position, knowledge, and capacity to become an ‘aggregator’ for current online tax training programs, now known as the Tax Aggregator Portal, or TAP. With an identified need amongst clients this serves three purposes.

- Firstly, it fills a current void and allows tax administrators around the world to search for courses based on their need and capacity for training.

- Secondly, it allows us to suggest pre-course materials for “junior- participants” that will be in one of our trainings soon. We experienced in many trainings that there is quite a variety in experience within the group of participants. For the most junior participants we can now suggest adequate pre course trainings so that they benefit much more from their participation in a Capabuild training or workshop.

- Thirdly, it allow us to recommend and/or create courses either in preparation for or to follow up on our ongoing seminars with our partners.

Not only is this an important gap in service, but it also fits with our existing skills and purpose and will closely complement the webinars/workshops/seminars that we co-deliver. The TAP is currently in a Beta version and is open for feedback from many of our partners. Our partner organization CFS, with whom Capabuild is working closely on TAP is working towards a release date of mid-2023 to coincide with their 5th Anniversary celebrations. The evolution of the TAP has created scope for many different uses as it can become a standalone portal, a guided learning pathway and an audit to recognize areas of future training need.

As busy professionals engaged in the ongoing work within their revenue services, accessing targeted, meaningful learning is difficult. By leveraging our existing training into self-guided units, tax professionals can receive instruction at a pace and level that is most suitable to them. This autonomous learning is part of student-centered learning preparing levelling of knowledge of students in preparation of courses we provide. In 2022 we adapted the Introduction to Transfer Pricing webinar which was delivered in conjunction with private sponsors and CFS to be a standalone course where students can work through the recorded lectures and PowerPoint resources in their own time. All aspects of the course are practical and hands on. Built into the course are a series of questions to check for understanding, with a requirement to pass the course if participants request certification. University courses and / or MOOCs are scarce in the international tax space (those existing courses are included in the TAP) but are often too theoretical or focus on a small aspect of a domestic tax law of a high-income country).

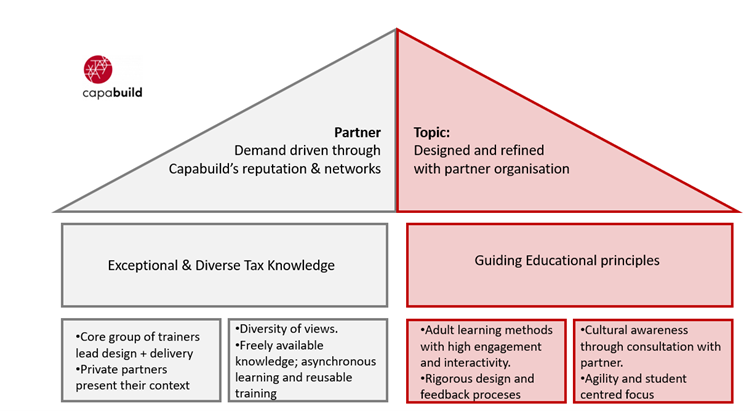

The model shows how expertise in educational knowledge combined with excellence in tax training is the core of everything we do. Capabuild prides itself on delivering rigorous and inclusive training with best practice methodology on engaging participants, and our approach to innovation sits at the forefront of this. As part of a constant culture of reflection, we look at issues that arose during our training and then explore available solutions/mitigations. The belief that removing obstacles to learning is key to allowing the global South to rise under its own will and direction drives our decision making. As well as the TAP and online learning courses mentioned in item 3., Capabuild continues to work on ways of using available technology to our advantage in reaching a broader audience with a deeper variety of topics. We do not develop new technologies ourselves but keep well abreast in the latest developments. Our innovation is focused on monitoring and evaluating new technologies and adopt them if useful to each context and training after careful assessments. Our partner revenue services share their experiences using new technology with us, and their value forms part of our monitoring and evaluation.

Lifting Language Barriers

We have seen the highly positive impact that simultaneous interpreting can have and would like to introduce this to webinars to allow all participants to access the expertise on offer. In an initial trial on this, over 2/3rds of participants used the interpreter, and throughout 2023 we will continue to explore ways of embedding this in any training we create. It sits firmly in our ethos of allowing participants to choose the way they learn and to make the learning the challenge, not accessing it.

New Software in Learning

We continue to refine and improve our methods and selected software to ensure it strikes the balance between making use of new developments and ensuring participants both can access it given bandwidth and device limits of our audience and are comfortable in using rapidly evolving software. Key to this is the range of options and activities which participants are offered for engagement.

Training Through Gaming

Part of this process in engaging audiences is the ongoing exploration of gamification. The use of gaming in learning has been a key feature of Capabuild webinars, with case studies, hypotheticals and interactive activities central. However, interactive online gaming that has tax learning as its core is a key goal over the coming years. The Foundation has worked with donors on this and will continue to explore the best avenues and options for producing a game that is meaningful, accessible to players in the global South, and enhances learning. All stakeholders are interested in gaming and learning, and we see mixed results. Many of the Capabuild team participated in a game on tax but we jointly decided it was not useful for our trainings, but future games may be. PKN Stan is developing games (Indonesia is a world leader in developing gaming). PWC’s trainer and game developer Mike Timmers will join PKN Stan later this year to learn and share gaming experiences. DG Tax in Indonesia is experimenting with using AI to draft legislation and is keeping us up to date on developments.

AI

Capabuild has already had successful trials with existing AI software and is aware of its limitations, rapidly changing nature and the tremendous potential it provides. Language translation and summary of large volumes of information have been the main areas of interest so far, and Capabuild sees potential for large scale integration while proceeding with caution.